The Oil Price Crash is Great for Solar & Renewable Energy

This is the turning point in the accelerating global transition from fossil fuels to renewable solar energy.

- First, massive oil price instability will hurt all future investments in oil and gas.

- Second, stable and cost competitive solar energy will get a boost from stimulus funding.

- Third, Coronavirus has made our pollution impact visible, which will further fuel consumer, corporate, and government demand for clean energy.

Oil & Gas Prices Are a Mess

With the breakup of the OPEC-Russia oil alliance, Saudi Arabia and Russia are flooding the market with oil. This just happens to coincide with the crash in demand from the Coronavirus pandemic. Oil prices have dropped from near $65 to below $25 – wow!

How will this impact the global transition to cleaner energy? What does this mean for the booming solar job market?

Traditional logic suggests that this would be bad for renewable energy, as oil and gas are now cheaper than they were before. With lower fossil fuel prices, this would result in fewer economic incentives to switch to renewable energy or electric vehicles. If natural gas remains cheap, solar has to be even cheaper to compete with that now lower price point.

Additionally, if there is reduced demand for energy overall, that would include reduced demand for renewable energy sources as well.

The head of the International Energy Agency, Fatih Birol, said that the oil price crash “will definitely put downward pressure on the appetite for a cleaner energy transition.†Simply because there will be less demand for new sources of energy until we have an economic recovery.

Long Term Outlook is Good for Stable Solar Energy

However, that is all short term. Those short term negatives for all forms of energy will be outweighed by the long term benefits. Long term, this oil price crash will accelerate the adoption of clean solar energy.

First, consumers and companies are becoming more socially responsible and demanding cleaner energy. That is not going to change. If anything, overall environmental awareness and appreciation will increase. Just search for the pictures of how clean the water in the Venice canals are without humans disturbing them.

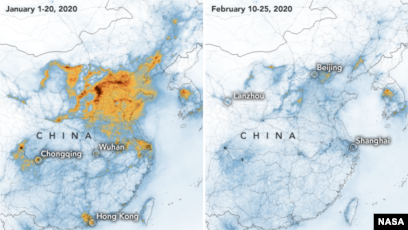

Coronavirus has already cut global emissions in the short term; it may also mean our transition away from carbon-intensive energy sources is accelerated in the long term. Who wants to return to seeing pollution in the skies?

Second, renewable energy has become increasingly competitive pricing wise. Solar energy and battery storage continue to drop in price and are now more competitive than even cheap natural gas. Solar will continue to get cheaper and has had a very consistent price trajectory.

Third, solar is more stable. Fossil fuels have tremendous instability. This is literally the second price crash in six years. The third in 10 years. It’s now much harder for investors to buy into long term projections for oil projects that take 10-15 years to full develop. No one wants a “stranded†investment where the price of oil is below the level needed to make a return, and no one can reasonably predict what the long term pricing trend will be. In short, with oil prices below $30, oil and gas projects can no longer claim to offer higher returns than clean energy projects.

Fourth, with global sentiment shifting away from fossil fuels, clean energy growing increasingly competitive, and oil market volatility once again in the spotlight – we may see oil majors and governments redoubling efforts to diversify energy investment. This is especially true in a world that is going to become increasingly vulnerable to pandemics.

Fifth, the stimulus funding from the U.S. and other governments is incentivizing energy efficiency and renewable energy.

In conclusion, this oil price drop AND the Coronavirus may be the one-two punch that delivers a knock out to the fossil fuel industry. For any professionals, the choice is clear, learn more renewables and invest in our shared future.

I have already done my solar voltaic program, just want advance myself. I believe Ever blue can help me attain such a level.