Energy Efficiency Tax Credits Available Through the Inflation Reduction Act

Under the Inflation Reduction Act (IRA) of 2022, federal tax credits and other deductions are available to American taxpayers to improve home and building energy efficiency, incentivize the adoption of efficient and electric appliances, help people save money, decrease building energy usage, and meet bold U.S. greenhouse gas emission reduction goals.

The IRA extended and even bolstered many of the energy efficiency tax credits that were previously offered under federal laws including the Energy Policy Act of 2005, the Emergency Economic Stabilization Act of 2008, and the American Recovery and Reinvestment Act of 2009.

IRA Updates to Section 45L

The IRA extended and modified Internal Revenue Code Section 45L, also known as the New Energy Efficient Home Credit, to provide substantial tax credits for new (or substantially reconstructed) energy efficient homes. The tax credits apply to both single and multi-family homes and are available through 2032. 45L tax credits are available to residential home builders and multi-family building developers.

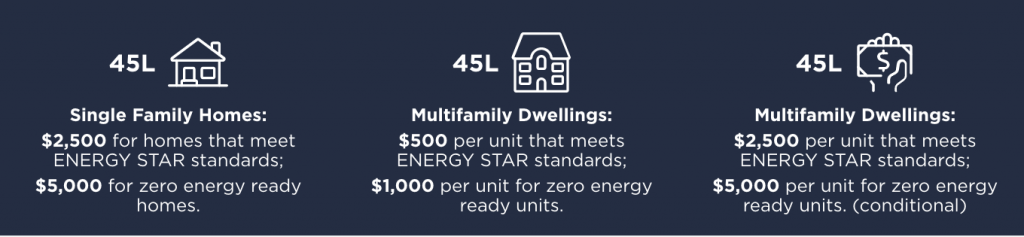

The new 45L provisions created by the IRA include two tiers of credits. Credits in the lower tier are available for single-family homes and multi-family dwelling units that are constructed according to ENERGY STAR standards. Under the IRA, new single-family homes are eligible to receive a $2,500 tax credit, while new multi-family dwelling units can receive $500 per unit.

The higher tier of credits created by the IRA is available to newly constructed single-family homes ($5,000 per home) and multi-family dwelling units ($1,000 per unit) that have met rigorous energy efficiency performance requirements set by the U.S. Department of Energy’s Zero Energy Ready Home Program. Zero Energy Ready Homes must also be ENERGY STAR-certified as a pre-requisite.

The IRA also boosts both tiers of 45L credits for multi-family building developers who ensure Davis-Bacon Act “prevailing wages†are paid to all workers involved in home construction projects. Specifically, multi-family, non-zero energy ready dwellings that follow prevailing wage requirements are eligible for an increased credit of $2,500 per unit, while Zero Energy Ready Homes following prevailing wage requirements are eligible for $5,000 per unit.

IRA Updates to 25C: Energy Efficiency Home Improvement Credit

One of the most important IRA provisions for homeowners is the new Energy Efficient Home Improvement Tax Credit (25C). Formerly known as the Nonbusiness Energy Property Credit, the IRA extended and revitalized this tax credit by substantially increasing the amount homeowners can claim on their taxes for energy efficiency home improvements.

Whereas previously, 25C provided a lifetime credit of $500 for homeowners, the IRA updated the credit to be annual, and will be available from January 1, 2023 until January 1, 2033. Additionally, the credit will now be worth either 30% of the overall cost of the home energy efficiency improvement project or $1200 (whichever is less).

The shift from a lifetime credit to an annual credit greatly benefits homeowners, who will now be able to spread out their home energy improvement projects over the 10-year life of the 25C credit. Each homeowner has the potential to receive up to $12,000 back on their taxes from this credit. In addition to the yearly $1,200 credit limit, homeowners can also qualify for an additional $2,000 credit for the installation of a qualified heat pump, heat pump water heater, biomass stove and boiler. However, there are certain energy efficiency performance requirements that these appliances must meet to qualify.

It is important to note that 25C tax credits can also be combined with rebates offered through DOE’s forthcoming $8.8 billion Home Energy Rebates Program, also created by the IRA. However, funds for this program will not be available to homeowners until at least early 2024.

Timeline and Next Steps

The increased tax incentives offered through 25C will go into effect on January 1, 2023 – meaning, taxpayers who undertake a home energy efficiency improvement project in their homes in 2023 may be eligible to claim the credit when they file their taxes in 2024. Also, homeowners who have already performed work in 2022 will still qualify for the pre-IRA tax credit amount of up to $500.

The IRS is expected to reveal additional details and requirements for the 45L and 25C tax credit provisions later in 2023.

The demand for home energy auditors and other skilled home energy performance contractors is expected to skyrocket as IRA funding becomes available. With homeowners, contractors and building developers alike eager to take advantage of the panoply of federal funding on the horizon, contractors should start preparing now by evaluating their workforce hiring, training and certification needs.

Contractors and home builders interested in the new 45L and 25C tax credits should pursue RESNET’s Home Energy Rating System (HERS) certification, which is key to being able to offer home energy audits and home energy ratings on new construction homes.

The RESNET home energy rating system (HERS) scores a home based on its level of energy efficiency. The HERS Index offers a score spectrum from 0 to 150, where 100 represents the energy use of an average house built to code and 0 represents a DOE Zero Energy Ready home.

HERS Raters work with builders to ensure that the homes are being built efficiently to meet 45L and ENERGY STAR requirements. HERS Raters are also qualified to provide home energy audits to homeowners wanting to qualify for 25C. Everblue conveniently offers an online RESNET HERS Rater Training course to help individuals earn the certification and qualify for these energy efficiency home tax credits.

Everblue has a long history of helping individuals and organizations meet their energy efficiency training and certification needs, at our weatherization training center locations nationwide and online. We’re equipped with years of experience supporting the implementation of federal funding – particularly during the American Recovery and Reinvestment Act era. Everblue also has longstanding partnerships with prominent credentialing bodies like the Residential Energy Services Network (RESNET), Building Performance Institute (BPI), government agencies, community colleges and vocational schools, and other organizations that will all play a role in implementation.

To learn more about how Everblue can help meet your unique training needs, give us a call at 800-460-2575 or sign up for the RESNET HERS Rater program.